Spall

Don't Return to Normal

2020 changed us. Keep changing.

Photo by Marla Prusik on Unsplash

By Emerson Schwartzkopf

Nobody wants to hear the answer of maybe or, even worse, a qualified maybe. Is it yes or no? Up or down? More steak, or back to beans? Five years ago this month, I started Stone Update Magazine with the idea (aside from eventually making a profit) that I’d always level with readers. Hopefully, I’m keeping to that principle, which sometimes is elusive as that profit notion. So, here’s my take: Yes, the boom is over. But, this isn’t going to be the rollercoaster ride of the late 2000s … as long as we keep paying attention. When I’m looking for answers in hard surfaces, I look to the numbers; specifically, the U.S. import data on natural stone, quartz surfaces and porcelain. In past years, the September-October editions of the magazine included a mid-year report with plenty of charts and data. In 2022, I’ll skip the long presentation. (If you’re hungry for raw numbers, you can check this issue of Hard-Surface Report.) The story this time involves a focus on totals and a few select charts. Really. You thought I’d leave out charts? First, here’s a head-to-head look at the customs value reported on hard surfaces coming into the United States in the first six months of this year and 2021. (You can move your cursor or, in the case of touchscreens, your finger to highlight any chunk of the bar graphs)

At first glance, it’s very, very good. Nearly every sector shows a gain from 2021. The grand total for January-June 2022 hard-surface imports comes to $2.65 billion, up 9.1% from the same time last year. So how is 9.1% not good? I’ll let the federal Bureau of Labor Statistics be the killjoy: 9.1% is also the year-to-year rise in June for the Consumer Price Index. Import values are up at the same growth level as the U.S. rate of inflation. This is likely an unhappy coincidence, but the matching climb rates show that inflation is going to be – at best – an equalizer to gains in value. There are plenty of complicated definitions of economic inflation, but the simplest is that things cost more to buy. Rising import values aren’t always indicative of industry gain.

At first glance, it’s very, very good. Nearly every sector shows a gain from 2021. The grand total for January-June 2022 hard-surface imports comes to $2.65 billion, up 9.1% from the same time last year. So how is 9.1% not good? I’ll let the federal Bureau of Labor Statistics be the killjoy: 9.1% is also the year-to-year rise in June for the Consumer Price Index. Import values are up at the same growth level as the U.S. rate of inflation. This is likely an unhappy coincidence, but the matching climb rates are showing that inflation is going to be – at best – an equalizer to gains in value. There are plenty of complicated definitions of economic inflation, but the simplest is that things cost more to buy. Rising import values aren’t always indicative of industry gain. It’s also worth noting that the customs value of hard-surface imports doesn’t include shipping costs from the country of origin. Getting a container of surfaces across the ocean involves a ride that’s still much-more expensive than in past years. But what about the actual physical amount of hard surfaces coming into the country? Let’s take a look.

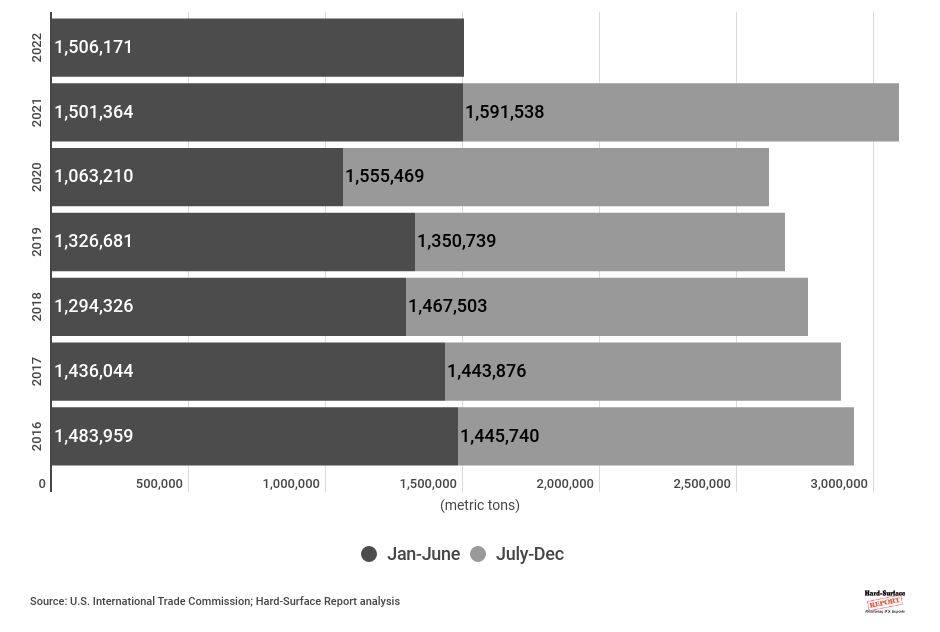

Add up all the tonnage of natural-stone imports¹, and the first-half/second-half split of tonnage is remarkably similar, except for the first six months of 2020. (Yeah, COVID-19). The amounts are better now than, say, three or four years ago. Consider the first half of this year with the same time in 2021. The 2022 number is larger, but by less than 5,000 tons. The growth rate is 0.3%; yes, that’s keeping pace with 2021, but it’s not a boom-quality growth rate. ¹These totals exclude non-roofing slate, where some of the material was measured by weight (metric tons), and the rest measured by area (square meters). U.S. import officials have fixed the discrepancy by weighing everything, but there’s no comparable data for all the years in this chart.

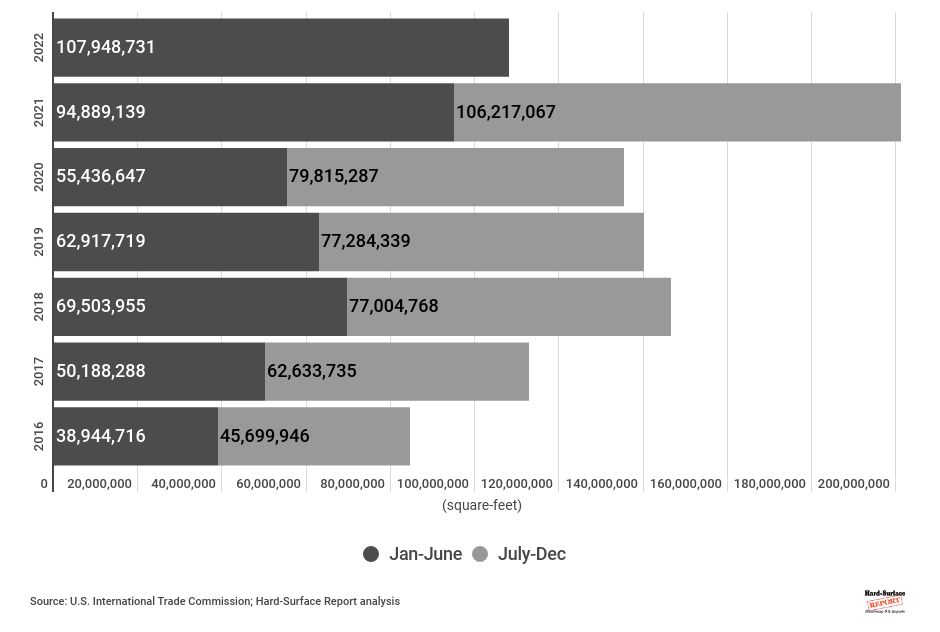

The numbers change dramatically with quartz-surface imports. OK, this is a boom chart, but I’m not as excited about it as I might’ve been a few years ago. Why? With quartz surfaces, it’s not the volume that bothers me; it’s the customs value. The monetary numbers are leveling out or declining, while the amount of materials appearing at U.S. ports-of-entry is going higher. This creates a real bargain-hunter environment, but it’s also temporary. The price of surfaces being shipped to the U.S. will go higher, and surpluses will disappear. And that’s not a boom scenario.

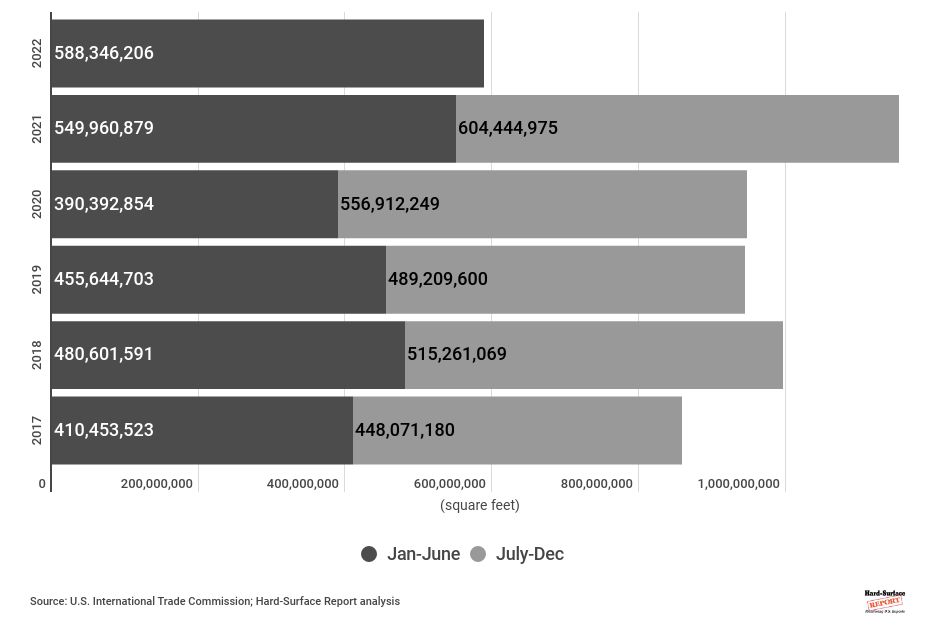

The same goes for porcelain, with the higher volume coming into the United States to service the pandemic-fueled market demand. The amount of porcelain rolling onto U.S. docks continues to increase at a steady clip, but the values of those imports aren’t keeping pace. It’s a buyer’s market, but the imbalance isn’t a sign of healthy growth.

The three multi-year charts also reveal one of those unwelcome facts when looking at history; COVID-19 is a terrible disease and worldwide scourge, but it also ironically helped to save businesses and jobs in the hard-surface trade. Look at those years from 2017-2020, and you’ll see a steady decline in import volume. That didn’t come with increased U.S. production of those same surfaces; numbers dropped because demand was falling while the U.S. economy, in general terms, looked marvelous. The pandemic led to a shift in market perception. People turned from switching houses to upgrading their current model. That’s going to continue, albeit at a much slower rate in the next few years. As an industry, we don’t need to be sitting pretty. If anything, we need to learn from the uncertainty of mid-2020 in looking for opportunities and being shrewd about investments. Remodeling will continue to fuel the market. Bargains in materials and machinery are out there due to the strong U.S. dollar, but they won’t last until this time next year. Business won’t fall off the cliff, like the late 2000s. Things will be good, but the fat times are behind us. COVID-19 was our booster. Now, we need to stay healthy.